Vast Resources plc (VAST ) has increased the exploration target for its Baita Plai Polymetallic Mine (‘Baita Plai’) in Romania significantly following the analysis of new drilling data.

Further to the recent Baita Plai JORC Resource and Reserve report, which confirmed a JORC gross resource of 608,000 tonnes at 2.58% copper (‘Cu’) equivalent and an exploration target in the range of 1.8M-3M tonnes, the Company can now confirm that the Antonio North skarn component may be more extensive than previously interpreted.

Following further analysis of additional historical drilling data, which has only recently been made available to the Company, the previous 0.2M–0.5M tonnes exploration target assigned to the Antonio North skarn can now be updated to between 1.4M–2.8M tonnes, giving an increased total gross exploration target for Baita Plai of between 3.2M–5.8M tonnes.

Based on these findings, the Directors believe that the Antonio North skarn now represents ‘a major near to medium term mining opportunity’ and is undertaking a further underground exploration drilling programme to better determine its full potential.

Andrew Prelea, CEO of Vast Resources PLC commented: “Antonio North represents a major opportunity for the Company not only to expand our production profile but also to significantly extend the life of mine plan at Baita Plai. In our initial exploration target of between 1.8M–3M tonnes, Antonio North represented 0.2M-0.5M tonnes; however, based on this new information Baita Plai and subject to further confirmation we will have an increased exploration target of between 3.2M–5.8M tonnes. The significant value potential of Baita Plai continues to reveal itself and we are committed to maximising this.”

The Antonio North Skarn

The Antonio North skarn is located approximately 200m to the north of the Antonio skarn.

Historic drilling from 15 level and 16 level identified a skarn below the Antonio skarn, which was subsequently mined between 15 and 16 level.

Underground development on 17 and 18 levels is limited and intersected the Antonio North skarn on the western margin of the skarn.

There is a major near to medium term opportunity for the mine to extend both the 17 and 18 level development along strike of the Antonio North skarn and to commence mining as the infrastructure is developed.

Limited mining of the Antonio North skarn has taken place on 17 and 18 levels due to the underground development not continuing below 16 level as depicted below:

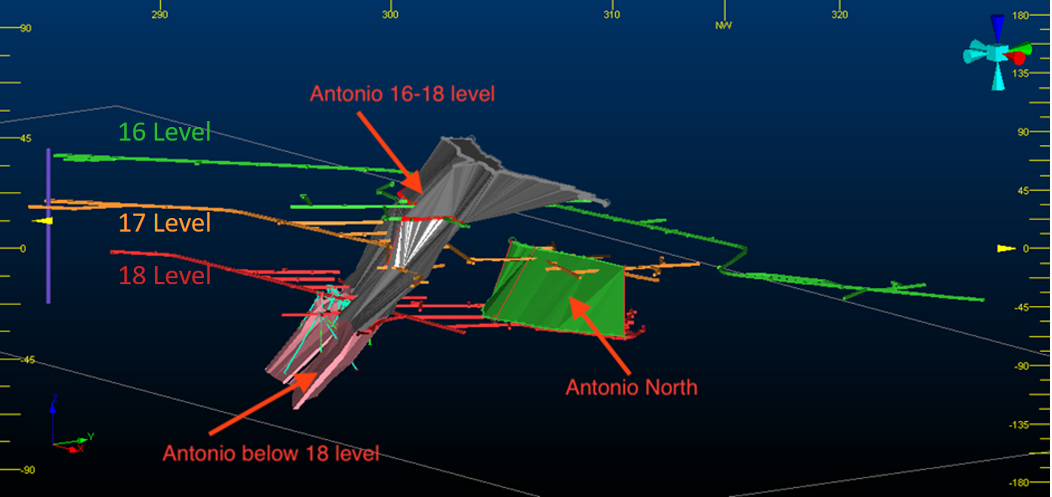

3-Dimensional Image showing the previous interpreted extent of the Antonio North Skarn

Description automatically generated[Source: VAST]

Description automatically generated[Source: VAST]

Analysis of the historical drill hole records, which are presumed to have been drilled in the early 1990’s, revealed numerous skarn intersections.

Unfortunately, not all the records had corresponding assay data or other data such as date drilled, type of drill used or where laboratory assays were undertaken.

The Antonio North skarn has therefore been interpreted from underground intersections in 17 and 18 level development on the western margin, from underground intersections in the 15 and 16 level development above, and from four historic underground drill holes drilled from 15 level.

The drill holes intersecting the Antonio North skarn are L-16, L-28, 1388BSK and 1389BSK. The assay values from these drill holes are provided in mm. A weighted average copper % is calculated as 1.66%, lead % at 0.02% and zinc % at 0.08%

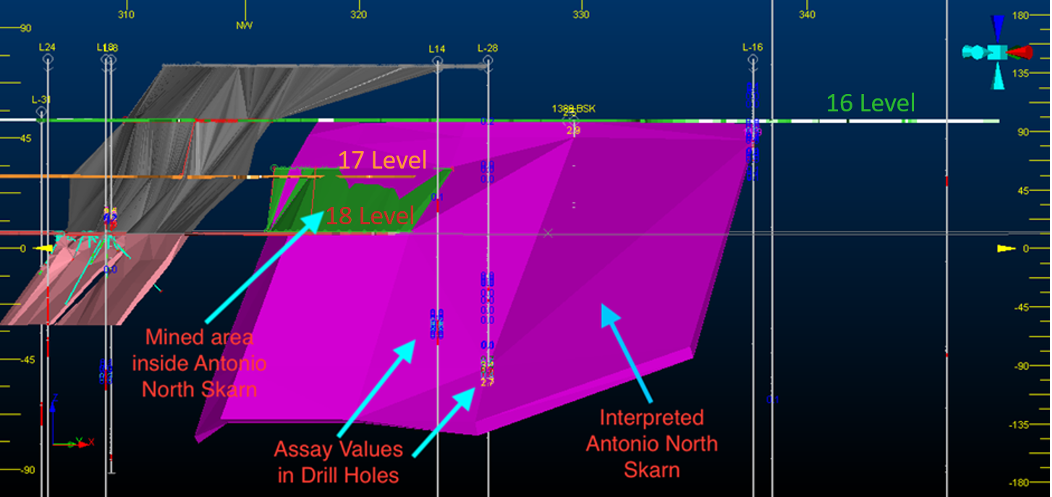

The drillholes and extent of the newly interpreted Antonio North skarn are depicted below:

3-Dimensional Image showing the extent of the newly interpreted Antonio North Skarn and the historic underground drill holes

[Source: VAST]

[Source: VAST]

Based on the recent drilling in the adjacent Antonio skarn, the Company expects that a similar grade range for copper, lead, zinc, gold, and silver would be present in the Antonio North skarn.

The historic drillhole intersections show that the grades are present and within the same broad range.

An underground drilling programme is being developed to test the geological interpretation by drilling a series of underground diamond drill holes from 15 level to intersect the Antonio North skarn.

Reasons to Follow Vast

Vast Resources plc is a United Kingdom AIM listed mining company with mines and projects in Romania and Zimbabwe.

Valuable Portfolio

- In Romania, the Company is focused on the rapid advancement of high-quality projects by recommencing production at previously producing mines:

- An 80% interest in the producing Baita Plai Polymetallic Mine, located in the Apuseni Mountains, Transylvania, an area which hosts Romania’s largest polymetallic mines. The mine has a JORC compliant Reserve & Resource Report which underpins the initial mine production life of approximately 3-4 years with an in-situ total mineral resource of 15,695 tonnes copper equivalent with a further 1.8M–3M tonnes exploration target. The Company is now working on confirming an enlarged exploration target of up to 5.8M tonnes.

- The Manaila Polymetallic Mine in Romania, which was commissioned in 2015, currently on care and maintenance. The Company has been granted the Manaila Carlibaba Extended Exploitation License that will allow the Company to re-examine the exploitation of the mineral resources within the larger Manaila Carlibaba licence area.

- In Zimbabwe, the Company is focused on the commencement of the joint venture mining agreement on the Chiadzwa Community Concession Block of the Chiadzwa Diamond Fields in Zimbabwe.

Multiple Re-Rating Catalysts:

- Vast is on track to surpass its initial copper concentrate sales delivery targets and expects delivery of between 350-400 tonnes of copper concentrate to commodity group Mercuria.

- Production of Cu concentrate in October was estimated to be more than 50% of the total FY20 target with first deliveries to Mercuria expected imminently.

- The Company expects to complete its asset-backed debt-financing for Baita Plai in December 2020 following its agreement with an unnamed international banking institution earlier this year

- Further positive Newsflow is expected on resource estimates at Baita Plai