[source: SED]

Saietta Group’s (SED ) first update highlights the significant operational progress the Company has made Update since its successful admission to trading on AIM in July 2021

The additional financial resources secured through the IPO in June have clearly enabled the Company to accelerate its interaction with a number of OEMs and progress its development plans significantly:

Electric Assisted Vehicles Ltd (“EAV”) - Saietta has entered into an exclusive supplier agreement of in-wheel traction motors for EAV’s proposed Lightweight Inner-City Solution (“LINCS”) vehicle. EAV has a variety of customers including, but not limited to, Veolia, DPD, Asda and Ocado as well as having a significant agreement with an unnamed major global OEM.

Marine Applications - Saietta’s marine division has commenced in-water testing of its first prototype e-outboard motors. More recently, the Company has commenced testing an inboard variant, which is suitable for both retrofit and new build applications, with a delivery date of 2022, to fulfil a pressing, regulatory-driven need for zero pollution marine propulsion in inland waterways.

Padmini VNA JV - The Company has continued to progress the joint venture to address the lightweight mobility sector in the Indian market and has already shipped a number of operating motorbike models retro-fitted with Saietta motors to India.

[Source: Saietta]

Wicher (Vic) Kist, Chief Executive of Saietta, said: “The rapid progress since we revealed our range of AFT motors late last year has been maintained with commercial, product and R&D progress continuing on all fronts.”

Global licensing - Saietta is continuing discussions with a range of Chinese OEMs with regards to offering a China domestic regional licence for tender during 2021. Given the large number of interested parties, the Company will now extend evaluation phase before finalising the process.

Wicher (Vic) Kist commented; “The high level of industry interest in our AFT technology since IPO has been remarkable and we are therefore deliberately being cautious and targeted as we select of our initial customers and partners.”

Target Market Expansion

In response to significant industry interest, Saietta has now commenced operations in the high-performance car market segment with the development of a production ready 800V high performance motor.

This development effectively opens a completely new market segment for Saietta, which was not envisaged at the time of the Company’s IPO earlier this year, with launch pencilled in for the summer of 2022.

Early Revenue Sources

While the Company continues to develop its motor durability test centre, commercial revenues have already been secured from September using a third-party test centre until its own centre is operational.

Production Ramp

Following the appointment of a new Head of Production, The Company has streamlined its processes to enable automated scaling up of production volumes.

Outlook

Following c. £2.0m of expenditure commitments and more than 90% increase in headcount over the past 12 months, Saietta has stated it remains on track to ramp up its UK-based production capacity to a target of 100,000 units per annum by 2024.

View from Vox

Saietta has clearly demonstrated it can successfully reduce the cost of axial flux electric drivetrains without diminishing performance, which is essential if EVs are to become mainstream.

Whilst its core focus during the period was the planned expansion of its UK production and testing capabilities, commercial traction with EAV will help it develop into a significant modular vehicle systems supplier over time with the potential for significant royalty and volume-based revenue should EAV’s customers adopt the LINCS platform.

The recent acquisition of Yasa, formerly Yokeless And Segmented Armature, by Mercedes-Benz should provide investors with a clear sign of how the automotive industry is increasingly looking for affordable EV drivetrains and Saietta is one of only a handful independent developers with production ready products left in the industry.

The market expansion into high-performance cars is also an exciting new market segment for Saietta, not mapped out at the IPO, should provide for a strong pipeline of positive newsflow over the coming 12 months.

Shares in SED have more than doubled over the past 12 months with the shares peeking at 240p in September. Whilst the shares have retraced some of these gains over the past three months, the shares remain well above the IPO opening price of 125p.

Reasons to SED

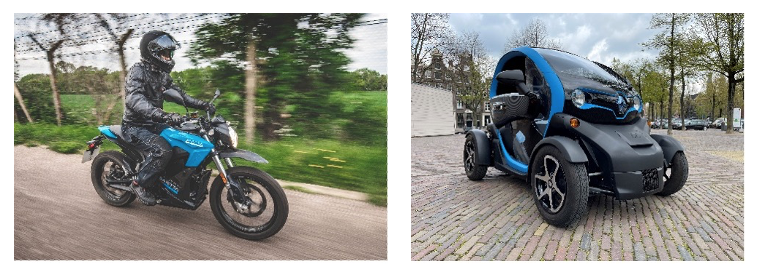

Saietta is an AIM-quoted, UK electric drive company, that has developed the innovative, and patent protected, axial flux technology (AFT) motor, which can power a wide variety of electric vehicles, ranging from scooters, motorbikes, cars, marine engines, through to larger vehicles.

Saietta has developed the low cost, low maintenance and highly efficient motor to enable the mass market electrification of the high-volume motorbike and lightweight vehicle market across Asia.

The global automotive manufacturing industry, which consisted of c. 74,000 enterprises and generated over $2 trillion of revenue in 2019, is experiencing substantial change as it transitions from internal combustion engines to electric motors.