For investors wishing to lean into the upbeat nuclear, defence, datacentre/AI, healthcare and energy sectors at an attractive price. Then look no further than specialist engineer Avingtrans - a niche picks & shovels play that sells & services (33% aftermarket) mission critical components into these areas.

Today in an encouraging H1’26 update, the board said that Nov H1'25 results were in line with management expectations. Adding too that the sales “pipeline remains buoyant” supported by a host of new possible contracts set to start in FY27.

Wrt the numbers, Cavendish have a SOTP valuation of 745p/share (incl healthcare), underpinned by an Est 95% revenue cover of their May FY’26 sales, EBITDA & adjusted EPS forecasts of £175m, £20.5m & 30.3p respectively.

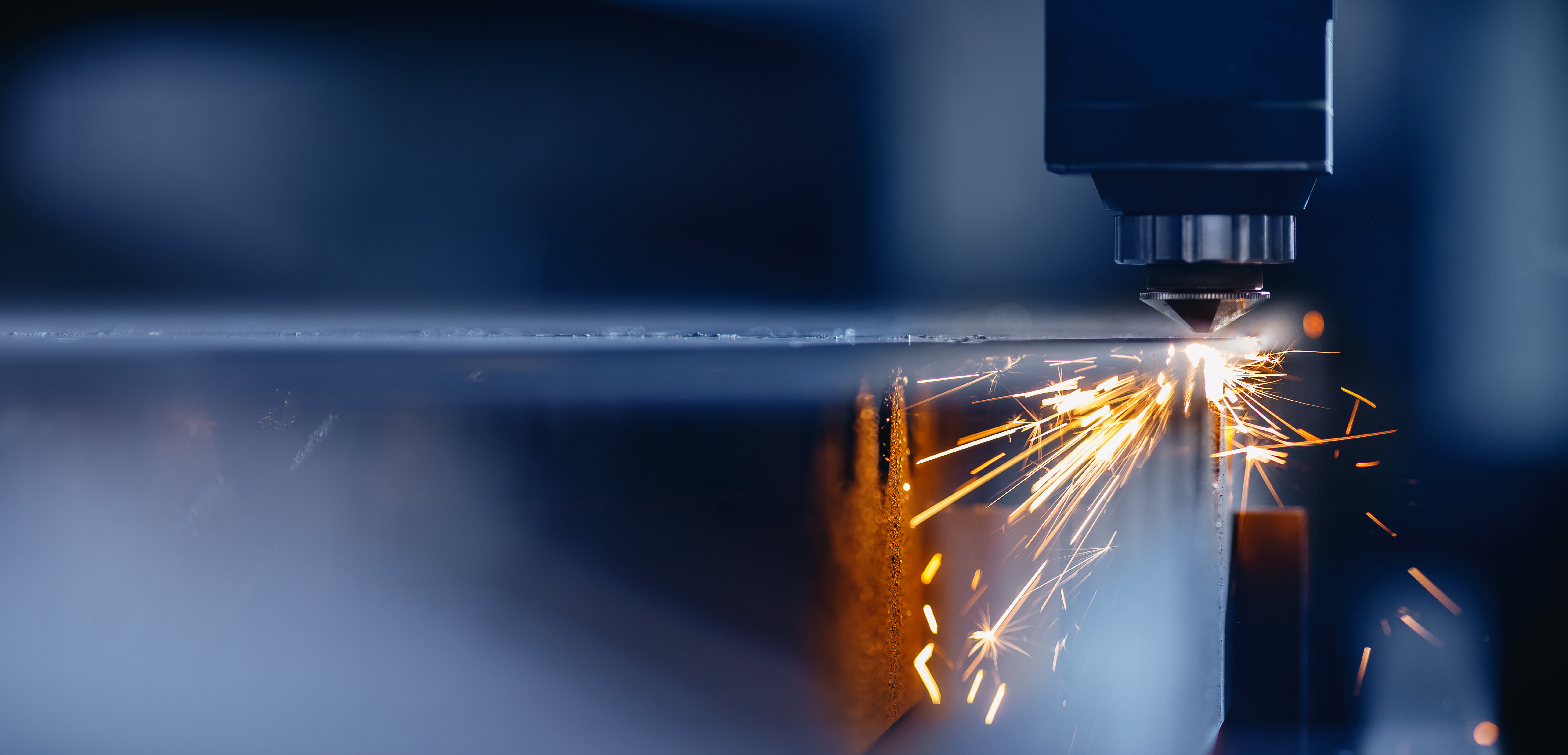

Here, hashtag#AVG's engineering division (AES) supplies cooling systems for data centres (Ormandy Rycroft Engineering) and high tech pumps for nuclear power (re new & life extensions - Hayward Tyler). Alongside ‘blast-proof doors’ for HS2 & defence applications (Booth) and high integrity waste storage boxes for decommissioning at Sellafield (Metalcraft of Mayville, Inc.).

What’s more in the last Spending Review, the UK government committed to its £4bn decommissioning programme - of which 75% has been allocated to Sellafield, one of AES’ largest clients. A further £40bn is also being invested in the new Sizewell C reactor, with Trump doing the same across the Atlantic. Nuclear energy and decommissioning represents >20% of turnover.

Elsewhere in Nov’25, Adaptix Ltd obtained FDA approval for its orthopaedic 3D image scanner, the Ortho350. An ultracompact low-dose, low-power imaging system that generates high quality 3D X-rays at the point-of-care to improve patient outcomes.

CEO Steve McQuillan commenting: “We are pleased to note the positive momentum continuing across the Group, particularly for those group businesses that are supplying products into AI and Data Centre driven markets, as well as the associated resurgence in nuclear power, albeit that the main growth effects of these tailwinds will not be seen until FY27 and beyond. The recently announced tie-up between TerraPower and Meta is exciting for next generation nuclear prospects."

Under the agreement, Meta will provide funding to support the buildout of up to 8 Terrapower reactors and energy storage system plants in the US to support the growing energy demand from data centers. An enormous investment (Est $10bn-$20bn), with some of this expected to flow down to Hayward Tyler. Given in Nov’23 it was awarded a $10m contract for the development of advanced sodium pumps for the Terrapower's demonstration facility (Est $4bn) in Wyoming.

H1’26 results are scheduled for 25th Feb’26.