Anexo Group plc (AIM: ANX ) has announced certain directors have placed their shares with a new major shareholder, at a premium to the prevailing share price, and announces 2H20 Trading Update.

Placing of Founder and Director Shares

DBAY has agreed to acquire a minority stake of 29.0% of the issued share capital of the Group from

Certain Directors of the Company at a price of 150 pence per share.

DBAY is an international Asset Management firm with offices in the Isle of Man and London.

DBAY set up its first investment vehicle in 2008 and now manages investments on behalf of institutional investors, family offices, pension funds, trusts and foundations in various funds.

DBAY will initially acquire 9.9% of the issued share capital of the Group prior to receipt of the necessary regulatory approvals from the Financial Conduct Authority and the Solicitors’ Regulatory Authority.

Once the various regulatory approvals have been received, DBAY will then acquire the remaining 19.1% shareholding in the Group, resulting in an aggregate stake of 29%, expected within three months of this announcement.

Upon completion of the second part of the transaction, DBAY will have the right to appoint up to three Non-Executive Directors to the Group’s Board of Directors.

Alan Sellers (Founder and Executive Chairman), Samantha Moss (Managing Director) Bond Turner (Sales Director) and Valentina Slater (Sales Director, Direct Accident Management Limited) are all staying with the Company and retaining their current positions.

Alan Sellers, Samantha Moss and Valentina Slater are also expected to provide undertakings which preclude any further disposals of their remaining shareholdings for a period of eighteen months following completion of the second part of the transaction and not to sell any part of their individual or collective holdings below the price of the transaction for a further twelve-month period.

Alan Sellers, Executive Chairman of Anexo, said: “We are delighted to welcome DBAY as a major shareholder in the Group. They have an excellent track record of smaller company investment and we look forward to working closely with them to achieve growth across our various business divisions.”

DBAY partner and Chief Investment Officer Saki Riffner said: “We are excited to invest in Anexo alongside Alan, who has built the business over the last 25 years, and we are looking forward to working closely with him and his team to drive the future growth of the Group.”

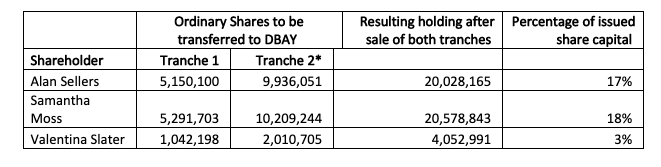

Holdings for Alan Sellers, Samantha Moss and Valentina Slater are provided in the table below:

Current 2H20 Trading

EDGE

Activity levels in the Credit Hire Division (EDGE) continue to be high.

The COVID-19 pandemic has led to a number of the Group’s competitors withdrawing from the market and, as a result, Anexo has been approached by a number of high-quality introducer garages looking for new partnerships.

The Group has leveraged this unprecedented opportunity to expand its introducer network; as a consequence, the number of vehicles on the road during H2 2020 has consistently exceeded internal targets and, as at 10 November 2020, stood at 1,902.

Despite the decline seen at the start of the first lockdown in March and April 2020, the average number of vehicles on the road for FY20 is expected to exceed the figure for FY19.

Bond Turner

The UK courts have remained open throughout the pandemic and the Group’s Legal Services division, Bond Turner, has continued to reach case settlements, either via telephone or online hearings.

The Group is maintaining its expansion in staff numbers and the necessary supporting infrastructure and expects this investment to continue to support case settlements and cash collections into FY 2021.

The Group announced on 28 January 2020 that a new regional office in Leeds for Bond Turner would open during FY20.

However, whilst staff have already been recruited, delays caused by the COVID-19 lockdown has meant the Leeds office will now become operational in the first quarter of FY21. Further, recruitment is expected to continue during the remainder of FY20 and throughout FY21.

Shares in Annexo have recovered some 30% since the global COVID-19 sell-off, rising from 103p at the end of March to close at 132.5p prior to this announcement.

FY20 Outlook

Anexo has confirmed that despite the COVID-19 pandemic, the Board expects overall cash collections for FY20 to be ahead of FY19.

The expansion of the introducer network and the corresponding increase in the number of vehicles on the road has led to the expectation that H2 2020 will be a period of cash absorption rather than cash generation.

Following its most recent marketing campaign concerning the legal action against Volkswagen AG (the ‘VW Emissions Case’), the Group is currently actively engaged on approximately 13,155 cases. These marketing campaigns are ongoing and, as previously announced, all associated costs are expensed as occurred. The Group continues to explore potential emissions claims involving other manufacturers.

The Group also plans to work closely with DBAY to continue the expansion of its Credit Hire and Legal Services divisions and confirms that it expects 2H20 underlying PBT (before investment in VW Emissions Case acquisition) to recover strongly from 1H20 levels and continues to trade in line with management expectations.