Verici Dx (AIM: VRCI ) has been admitted to AIM with trading in its shares expected to commence at 8am today.

The Company also raised £12.05m through an oversubscribed fundraising, with the issue of 72.5m New Ordinary Shares, to primarily fund the development and commercialisation of the Company’s two leading clinical products in the kidney transplant space.

Based on the Placing Price, the market capitalisation of the Company will be £28.35m on Admission with 141,747,816 shares in issue.

Sara Barrington, CEO of Verici Dx, said: “We are very grateful for the strong support shown by institutional and other investors to the Verici Dx IPO. Obtaining funding in a public market is a strong signal of quality to prospective partners and customers, raises the profile of the business and its innovative products considerably, and gives us a supportive platform as we advance our strategy.

We look forward to providing further updates on the execution of our validation and commercialisation plans as we deploy the capital raised towards addressing a significant unmet clinical need.”

Company Introduction

Verici Dx is an immuno-diagnostics development company, initially focussed on the US kidney transplantation market.

Based on IP originally licensed from Mount Sinai, Verici Dx addresses a large and underserved kidney transplant market with innovative and proprietary products.

The Company's kidney transplant assays use advanced next-generation sequencing that can define a personalised risk profile of each patient over the course of their transplant journey, and may also detect injury in advance of currently available clinical tests.

*WATCH* CEO, Sara Barrington and Dr Barbara Murphy Introduce the Company to Investors

[Source: Vox Markets}

The Company’s products and solutions indicate how likely to respond to the transplanted organ and how that response further influences acute rejection, chronic injury and, ultimately, failure of the transplant and may also assist clinicians as to the optimal strategy for immunosuppressive and other therapies to enable successful graft acceptance.

Both the company’s leading products have largely completed their initial development work and are both now expected to undergo commercial launch within two years.

The Company’s two leading products for commercialisation are branded:

- Clarava™ - a pre-transplant prognosis for the risk of Early Acute Rejection (“EAR”)

- Tuteva™ - a post-transplant diagnostic focused upon Acute Cellular Rejection (“ACR”)

The Clarava™ gene expression signature provides prognostic information to clinicians reliable ‘risk scores’ giving clinicians valuable information on the degree of risk in the nature of the likely immune response to the transplant or graft.

The Tuteva™ gene panel test reviews the cell repair and metabolism pathways as well as immune response to give clinicians a tool that directly correlates with active rejection of the graft, rather than the indirect measurements currently available from other technologies which measure the resulting “debris” from attacked cells.

Both tests only require a simple blood draw at the transplant centre using a test tube that stabilises the sample and enables a benign transfer to the company’s testing laboratory.

The sample is processed, and the result is then sent back to the requesting clinician. Sample processing is expected to take 3-5 days.

Brief Background

On 21 December 2018, Mount Sinai granted RenalytixAI (RENX <follow>) a worldwide exclusive licence to four patents relating to the underlying technology, and a non-exclusive licence to the related technical information and materials in respect of diagnostics and prognostics for kidney transplant rejection.

Verici Dx was incorporated on 22 April 2020 as a wholly owned subsidiary of Renalytix and the licence was subsequently assigned to the Verici on 4 May 2020 as part of the transfer of the business and assets of the FractalDx portfolio from RenalytixAI. The asset purchase price of $2.0m was satisfied by the issuance of loan notes by Verici to RenalytixAI.

Upon commercialisation of the products, it is expected Verici will pay Mount Sinai a royalty on products covered by the licensed patents.

Significant Market Opportunity >$600m p.a.

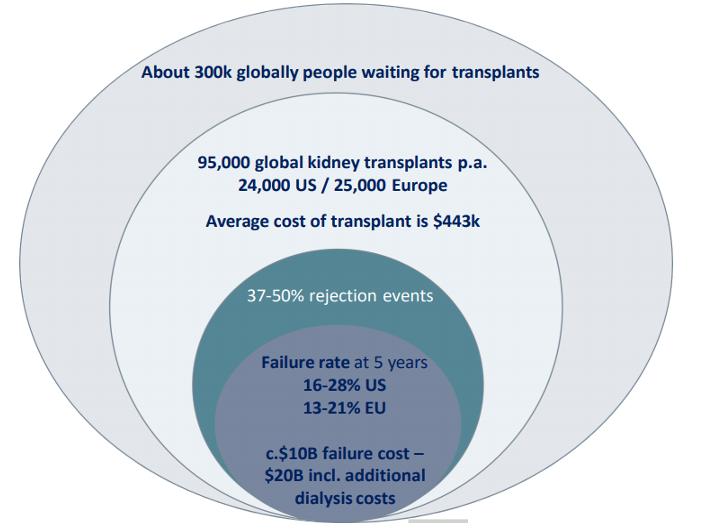

The waiting list for transplants is significant at approximately 300,000 globally with both US and European governments calling for an acceleration in the number of transplants undertaken each year.

Globally, there are approximately 95,000 transplants per annum, of which approximately 24,000 and 25,000 are performed in the US and Europe respectively.

In the US the average cost of a transplant is $0.44m per transplant and the average annual cost of dialysis is approximately $0.09m, with patients faced with being on dialysis from 3 to 5 years.

[Source: Company]

It is estimated that about 37% to 50% of all grafts will experience a clinical (>10%) or subclinical (< 40%) rejection condition in the first year following transplant and the clinicians use immunosuppression therapy to try to manage the rejection risk.

Despite that, the failure rate in the US has remained largely unchanged at approximately 16 per cent. (live donor) to 28 per cent. cadaver at 5 years. In the EU this is 13 to 21 per cent. respectively.

The cost of failure of a transplant/graft is therefore not only devastating to the patient but places a high cost burden on the health system overall.

The clear opportunity for Verici Dx is to address and mitigate the $10bn ‘failure cost’ of transplants and the $20bn of additional dialysis costs for healthcare providers.

Listed Life and Use of Proceeds

The Board of Verici plc consists of Non-Exec Chair, CEO and CFO with 4 non-executive directors:

Net Proceeds

- The net proceeds of the Fundraising, in the first 21 months post Admission, will be invested to:

- Undertake clinical utility and validation studies for the Clarava™ and Tuteva™ products, which are expected to begin in late 2020

- Further development of proprietary bioinformatics and health economic studies

- General corporate overheads, including marketing and business development and general working capital purposes

- Licence, royalties and capital expenditure (including to build additional testing capacity) and resourcing potential strategic partnerships.

Key Shareholders

Significant shareholders include several of the original Board members of EKF, and subsequently RenaytixAI, and the Board of Verici

3 Reasons to Follow Verici Dx

Leading Proprietary Products to address the large kidney transplant markets

Verici has two leading products targeting the large and increasing kidney transplant markets where there is a chronic shortage of kidneys available and a poor allocation of kidneys with 16-28% of transplant recipients likely to experience graft loss from rejection of their donated kidneys within five years.

Positive Development Newsflow

Verici aims to commence a multi-centre validation study for each product in 4Q20, with studies expected to conclude in 4Q21. Clarava and Tuteva are then expected to be offered as Laboratory Developed Tests with regulatory approval with first revenues expected during 2022.

Simultaneously, the Company expects supportive news flow throughout 2021 on commercial partnerships, regulatory news, reimbursement and results from test development programmes.

Once approved, the Company aims to accelerate reimbursement coverage ahead of full clinical utility data in 4Q22.

Strong Management Team with Successful Track Record

The Non-Executive and Executive Board of Verici are ‘tried and tested’ industry and equity capital markets veterans with demonstrable success at BBI Holdings plc, EKF plc and Renalytix plc.

We therefore expect the Board to be proactive in the market and deliver Newsflow on-time to support investors of all classes in the Company.