Union Jack Oil (UJO ) has told investors that the first phase of the evaluation programme on the WNB-1Z discovery well at West Newton is planned to commence during April 2021.

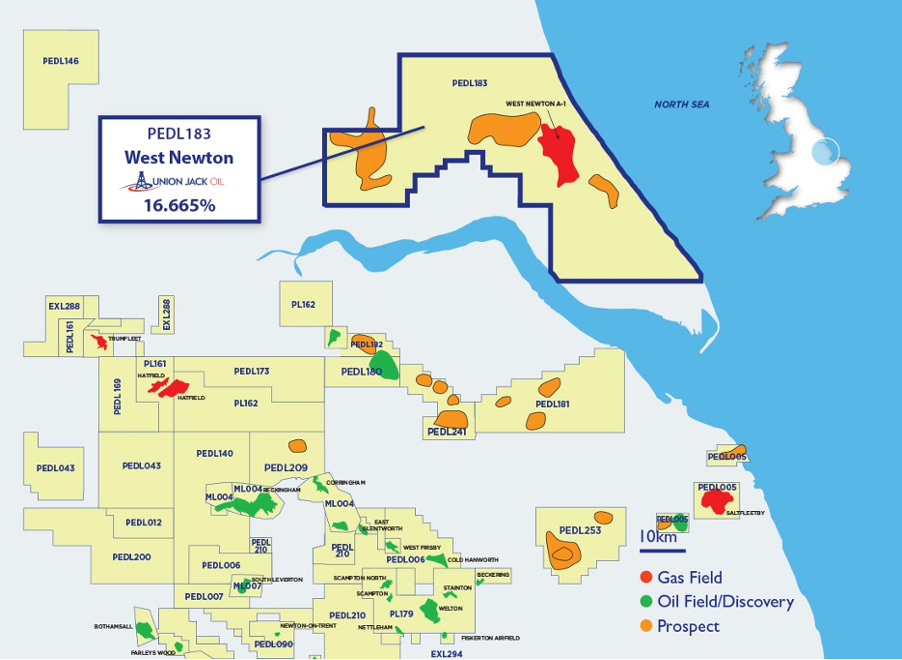

UJO holds a 16.665% economic interest in PEDL183, encompassing an area of 176,000 acres and located within the Western sector of the Southern Permian Basin, onshore UK, North of the river Humber. PEDL183 contains the WNA-1, WNA-2 and WNB-1Z discoveries.

PEDL183 (Figure 1) contains the conventional West Newton A-1 discovery well ("WN-A1"), the A-2 appraisal well ("WN-A2) as well as the recently drilled B-1Z discovery ("WN-B1Z").

(Source: Union Jack Oil)

The Operator of PEDL183, Rathlin Energy, applied to vary the West Newton B Wellsite permit and said it has now received a draft of the varied permit from the Environmental Agency ("EA") that will accommodate completion, well clean-up and EWT operations.

In a research note released today, UK-based Arden Partners highlighted that full receipt of this permit will be “a key clearance” required in order to carry out the flow testing programme for the B1Z well which was originally drilled back in 4Q20. It said a similar clearance is already in place for the A site, helping facilitate flow testing of the A2 well.

UJO said the first phase of evaluation will include a cased hole logging programme as well as vertical seismic profiling which is expected to take around two weeks.

The processing and interpretation of the data acquired will inform the completion, well clean-up and EWT operations on the Kirkham Abbey formation for the WNB-1Z well.

‘It will be positive to see the testing process kicking off in the coming weeks, and the actual flow testing itself should follow a few weeks after the new logging surveys,’ Arden noted.

UJO said data gathered from the completion and EWT programme will be incorporated with the existing information to produce a new Competent Person's Report ("CPR").

The company highlighted that discussions regarding the appointment of a highly respected global consultancy to produce a CPR on West Newton are currently “at an advanced stage.” It said the JV expects to be in a position to announce this appointment in the near future.

Looking ahead, Arden highlighted how West Newton remains UJO’s key asset and that this is likely to be the core focus of news flow and market attention in the coming months.

“The JV will be conducting flow tests of both the B1Z and A2 wells, aimed at providing data to define the hydrocarbon phase at West Newton, to help define potential recovery levels and also to allow the JV to give more detail on potential development plans. This is all vital for the future of West Newton, and the flow tests represent important events for the shares,” it added.

Rathlin believes West Newton has the potential to provide local feedstock to a Humber net zero project replacing the need for imported hydrocarbons while at the same time developing indigenous energy sources, contributing to the economic welfare of the Humber region.

Shares in UJO have risen by over 10% since the start of 2021. The stock was trading 1.45% higher this morning at 35p following the group’s update on PEDL183 at West Newton.

Reasons to UJO

UJO is an onshore oil and gas exploration firm with a focus on drilling, development and investment opportunities in the UK hydrocarbon sector, and currently holds interests in 13 licences in areas including, inter alia, the East Midlands, Humber Basin and East Yorkshire.

West Newton

The UK focused onshore hydrocarbon explorer holds a 16.665% interest in PEDL183, containing the conventional West Newton A-1 discovery well and WNA-2 appraisal well.

West Newton is located at the heart of the Zero Carbon Humber project area, which aims to promote decarbonising technologies across industrial activities in the wider Humber region.

In October 2020, it reported that the onshore West Newton B-1 ("WNB-1") well - the next well following the successful West Newton A-2 ("WNA-2") appraisal well - had been spud.

Results from the drilling of WNB-1 are expected to inform a subsequent programme of testing to establish the well's productive capability as well as future drill operations.

North Kelsey

In recent months, UJO also increased its stake in the North Kelsey project by acquiring an additional 30% from Egdon Resources, taking its stake in the exploration project up to 50%.

Further financial obligations will be equal between Union Jack and Egdon Resources, in line with both parties’ 50% stake in the North Kelsey Prospect which is located in Lincolnshire.

The North Kelsey Prospect is a conventional oil prospect along trend from and analogous to the Wressle oil development, which lies around 15 kilometres to the northwest.

The UK- focused group said the prospect has been mapped from 3-D seismic data and has the potential for oil in up to four stacked conventional Carboniferous reservoir targets.

David Bramhill, Executive Chairman of UJO, described North Kelsey as “a low cost, drill-ready onshore acquisition for Union Jack in our focus area, consistent with our strategy.”

He said a further stake in the project increases the group’s exposure to a “potentially value adding project” as well as expanding UJO’s balanced drilling and development portfolio.

Subject to a successful farm-out, North Kelsey-1 is expected to be drilled during 2021.

Wressle

In recent months, Operator, Egdon Resources U.K. Limited, commenced operations to re-complete and reperforate the well located at the Wressle hydrocarbon development site.

The Ashover Grit reservoir is expected to produce 500 barrels of oil per day at a constrained rate, increasing UJO’s net production by an additional 200 bopd when fully on stream.

Follow News & Updates from Union Jack Oil here: