Proactis Holdings (AIM:PHD ) announced its first contract for the provision of bePayd, its accelerated payment service, with French service provider Experbuy.

Experbuy, is a subsidiary of EPSA marketplace (“EPSA”), which offers business process outsourcing solutions to boost productivity and profitability of their clients through support with purchasing, cost control through tax optimisation, social security and occupational accidents; and e-commerce.

This contract is for Experbuy to deploy bePayd for use by its own suppliers, which aggregates to approximately €180 million of annual spend across 65,000 suppliers.

bePayd will therefore enable Experbuy’s suppliers to quickly pay an approved invoice, in return for a small discount, which is perfect for the ‘long tail’ of small suppliers in the supply chain.

bePayd is fast ‘without any detriment to security or risk and is entirely flexible down to a single invoice level with extremely low values because of the end-to-end automation of the process.’

Funding of the early settlement can be provided by the customer (as is the case with Experbuy), Proactis (through a dedicated facility with HSBC) or a blended model, it noted.

"I am delighted to have signed our first bePayd contract with Experbuy, part of the EPSA Group. We look forward to working with Experbuy to drive take-up of this great service to suppliers over the coming months and beyond,” said Tim Sykes, Proactis’ CEO.

He added, “As we look forward, the solution has never seemed more relevant, and with a healthy pipeline of opportunities, we are optimistic about its prospects in 2021."

Shares in Proactis have increased by over 12% in the past month to open 1.22% higher this morning at 41.5p following the announcement.

Reasons to Follow Proactis

Proactis creates, sells and maintains software and services, which enables organisations to streamline, control and monitor all indirect expenditure. Its solutions are used in around 1,100 buying organisations globally from the commercial, public and not-for-profit sectors.

Proactis previously adopted a new go-to market strategy for each of its US, France and Germany territories which is designed to replicate that of the UK and Netherlands.

In its FY20 results last month, Proactis noted that it had made ‘substantial headway’ after seeing the first sales of its mid-market single platform solution in Germany and France.

The group cited a ‘record year’ in new business total contract value ("TCV") after securing an aggregate of £14.6m (FY19: £11.3m), a 29% increase secured in ‘virtually all markets.’

Proactis said this demonstrates ‘the effectiveness of its strategy, the resilience of the business model and the ability of its teams to deliver despite a change in working practices.’

In recent weeks, the company announced that it has signed a 3-year contract with an unnamed major German DIY retailer to provide its business spend management solution.

The business spend management provider said the win represents ‘a strategically important milestone’ as the second new German customer to sign up under that new strategy.

Proactis, whose solutions are used in around 1,000 global buying organisations from the commercial, public and not-for-profit sectors, said the solution will be deployed in Germany initially before being rolled out into new territories through Central and Eastern Europe.

Compelling Valuation Metrics

While it remains undetermined of how much today’s contract could generate, consultancy firm, PMH Capital, highlighted to investors that “we would guess a firm like Experbuy might generate £50k-£100k pa for Proactis – dependent on transactional volumes.”

It added, “Plus, multiply this a few 100x, & you end up with a substantial, high margin & very valuable, recurring revenue stream. bePayd has the potential to be enormous, given its 1st mover advantage in providing cashflow benefits to SMEs within this ‘low value’ space.”

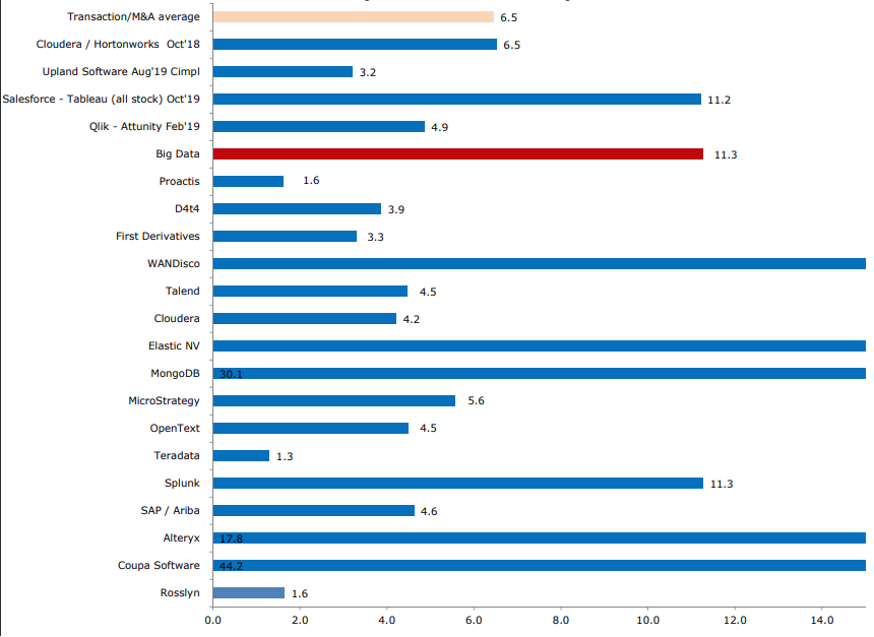

Furthermore, research from PMH Capital suggests Proactis is currently trading at a significant discount to its peers on an EV/Sales multiple of 1.6x, against an average of 6.5x for the sector.

Fig 1: Current Year EV/Sales

[Source; PMH Capital]

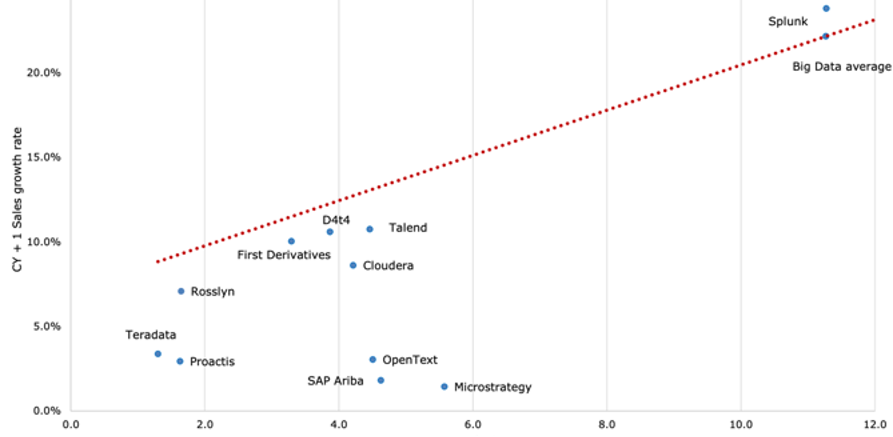

Figure 2; Current Year EV/Sales Vs CY1 Revenue Growth

[Source; PMH Capital]

Paul Hill of PMH Capital wrote that, “If it can ultimately generate LFL top line growth of 10%+ pa, then I would value the stock at a minimum of 4x EV/turnover, or >150p/share.”

Follow News & Updates from Proactis Holdings here: