In its half-year results for the six months to 30 June 2021, Polarean Imaging (POLX ) hailed its oversubscribed placing whereby its raised £27m, the group’s largest financing to date.

The medical-imaging technology company raised £27 million gross proceeds back in March 2021 to enable it to prepare for commercialisation and launch post the approval of its proprietary drug-device combination in the US, the largest healthcare market globally.

Richard Hullihen, CEO of Polarean, commented: "During the first half of 2021 the Company raised its largest financing to date with its oversubscribed £27 million gross proceeds financing. We appreciate the continued support from our existing strategic, institutional and retail investors and welcome several new significant institutional investors.”

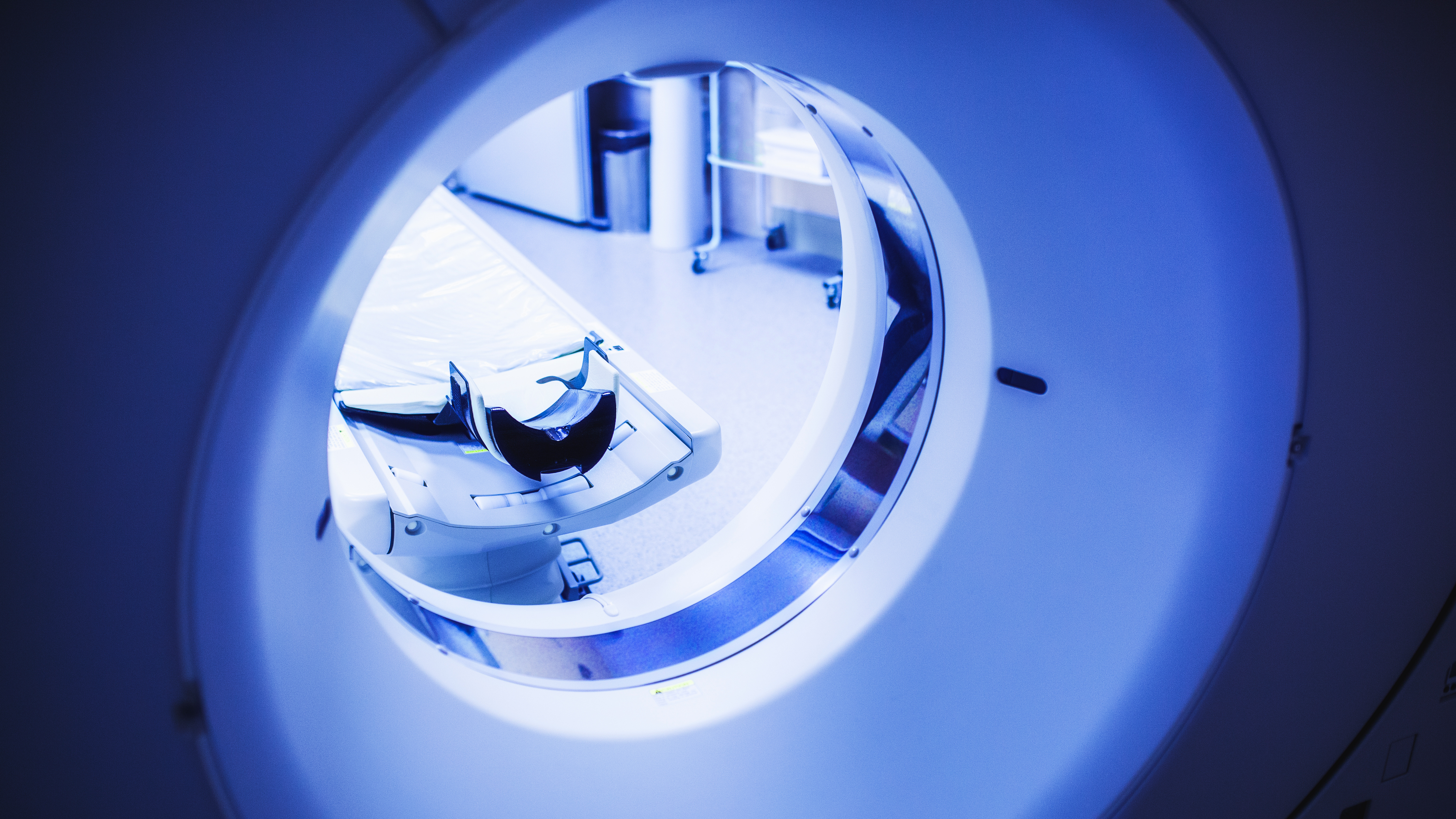

Polarean originally submitted a New Drug Application to the US FDA for its hyperpolarized 129 Xenon gas used to evaluate pulmonary function and to visualise the lung using MRI in October 2020. This NDA application was later accepted by the US FDA in December 2020.

At the time, the FDA informed Polarean that the NDA will follow a Standard Review process, with a target Prescription Drug User Fee Act (“PDUFA”) action date of 5 October 2021. Since then, Polarean has remained focused on advancing preparations ahead of the launch.

The submission of the New Drug Application and its acceptance from the US FDA has followed successful Phase III clinical trials, where both trials met their primary endpoint.

Hullihen said the £27m proceeds are being used by Polarean to plan and execute the launch of its product in accordance with its current target PDUFA date of 5 October 2021.

In the meantime, the Company informed investors that it continues to sell new polarisers systems for research use, as the amount of polarised Xenon research continues to increase.

Today, Poalrean noted that it has made ‘substantial progress’ during the six-month period to 30 June 2021 towards its goal of seeking FDA approval for its drug-device combination.

Polarean’s technology offers an investigational diagnostic approach in an area of significant unmet medical need to offer a non-invasive and radiation-free functional imaging platform. The annual burden of pulmonary disease in the US is estimated to be over $150bn.

‘Given the limitations of existing methods of diagnosis and lung disease monitoring, we estimate that there is a significant unmet need for safe, non-invasive, quantitative, and cost-effective image-based diagnosis technology,’ the Company highlighted to investors.

Addressing investors, the Group said it believes that its medical drug-device combination utilising 129Xe offers the ideal solution for improving pulmonary disease diagnosis.

Group revenues for the first half were US$0.6m (2020: $0.3m) and were largely derived from the sale of a polariser system to MD Anderson, in contrast to the 1H20 revenue, which was largely from its collaboration with the University of Cincinnati for work under its SBIR grant.

Operating expenses for 1H21 (US$5.5m) rose from 1H20 (US$3.4m), as Selling and Distribution Expenses (1H21 $1.8m) rose as it executed plans for commercial launch.

Following Polarean’s completed £27m (~$37m) fundraise during 1H21 via the issue of new equity and as at 30 June 2021 the firm held US US$38.2m in net cash or cash equivalents.

Polarean said its latest new techniques lead the business into the field of cardiology and pulmonary vascular disease which is one example of the further potential of its technology.

Looking ahead, the Company told investors that it is currently in discussions with several research institutions and anticipate additional possible orders during calendar year 2021.

‘This is an exciting time for the Company, as we enter the final stages of submitting our NDA and look towards a potential commercial launch before the end of 2021,’ the Company said.

Shares in Polarean Imaging have increased by over 30% since the beginning of the year. The stock was trading 0.57% higher during late morning trading at 86.99p following the news.

Reasons to POLX

The Group and its wholly owned subsidiary, Polarean, Inc. are revenue generating, medical drug-device combination companies operating in the high-resolution medical imaging market.

Polarean’s equipment enables existing MRI systems to achieve an improved level of pulmonary function imaging and specialises in the use of hyperpolarised Xenon gas (129Xe).

The Group utilises the hyperpolarised Xenon gas (129Xe) as an imaging agent in order to visualise ventilation and gas exchange regionally in the smallest airways of the lungs, the tissue barrier between the lung and the bloodstream and in the pulmonary vasculature.

Polarean operates in an area of significant unmet medical need and its technology aims to provide a diagnostic approach, offering a non-invasive and radiation-free functional imaging platform which is more accurate and less harmful to the patient than current methods.

The annual burden of pulmonary disease in the US is estimated to be over US$150 billion.

In December 2020, Polarean confirmed that the US FDA had accepted the Group’s new drug application (NDA) for its drug device combination product using hyperpolarised xenon-129 gas.The US regulator informed the Group that the NDA will follow a “standard time frame”.

This means that the target Prescription Drug User Fee Act or PDUFA date is now 5 October 2021 - this being the deadline by which the FDA must review all new drug applications.

Hullihen told investors, "FDA acceptance for the filing of Polarean's NDA represents another important step forward for the Company's platform. If approved, Polarean's drug-device technology could provide a new diagnostic option for patients with pulmonary disease.”

Polarean told investors that following the achievement of this latest milestone, that it plans to make ‘full use of this time with regards to commercialisation and launch preparation.’

Follow News & Updates from Polarean Imaging here: