In its 1H21 results, Michelmersh Brick Holdings (MBH) told investors that it has made “a very strong start to 2021,” with revenue and profit ahead of its 2019 pre-Covid-19 performance, thereby prompting the Board to declare an interim dividend of 1.15 pence per ordinary share.

The specialist brick manufacturer said its performance in 1H21 has fallen ahead of 2019 pre-Covid-19 comparison ‘across all financial metrics’ with the Company’s operational leverage and focus on production efficiency supporting margin growth ahead of 2019 levels.

The Company said the ‘very strong set of results’ have benefitted from the continuing recovery of the construction sector, which started to improve in the 3Q20, and that the fundamentals in its end markets importantly remain well backed by Government policy.

As a result, it has declared an interim dividend of 1.15p (30 June 2020: £nil) to reflect its commitment to a progressive dividend policy and its confident outlook for the business.

The Company outlined to investors that the interim dividend will be paid on 13 January 2022 to members on the register on 3 December 2021. The Group will also offer shareholders a scrip alternative to a cash dividend with a scrip election date of 20 December 2021, it said.

With this dividend, it is returning to its policy of one third of the total annual dividend being paid at the interim stage and two thirds of the total annual dividend being paid at the full year.

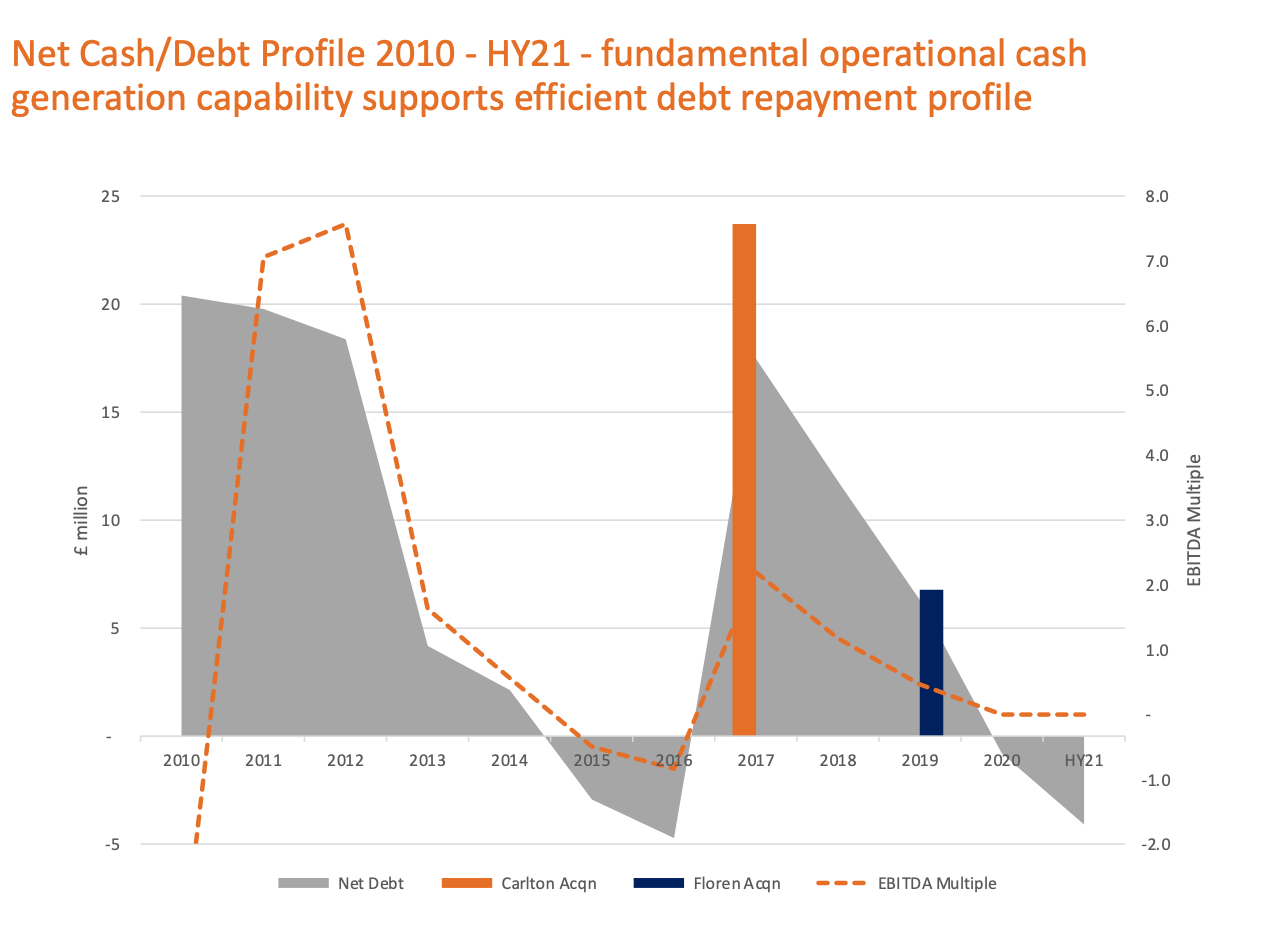

Overall, the Group said its results underline its continuing success of improving efficiency and returns from its existing business, as well as the benefit of reduced finance costs from the voluntary repayment of £10 million of borrowings at the end of the 2020 financial year.

Revenue for the six months increased by 32.9% to £29.9m (HY20: £22.5m) over the equivalent period in 2020, which included the impact of the 4-week manufacturing shutdown, and by 9.9% (HY19: £27.2m) against the comparable 2019 six-month performance period.

As a result of the strong revenue growth, operating profit of £5.2m was up 126.1% and 20.9% on 2020 and 2019 respectively and profit before tax of £5m was up 150.0% and 25.0%.

Michelmersh said cash generated from operations for the six months ended 30 June 2021 was £6.7m, compared to £3.2m for the same period in 2020, benefiting from the strong six months of trading conditions and continued focus on managing working capital efficiency.

(Source: Michelmersh Brick Holdings 2021 Interim Results Presentation)

Operating cash conversion from adjusted EBITDA was 88.2% vs 65.9% and 87.1% in 2020 and 2019 respectively, to reflect the firm’s underlying fundamental cash generating ability.

At the half year the Group had net cash of £4.1 million being cash of £14.8 million less bank debt of £10.7 million (30 June 2020: debt of (£6.5 million); 31 December 2020; £0.8 million).

The Company highlighted that its operating cash generation, net cash position and strong balance sheet provides it with the capacity to continue to invest in the business to support both capital initiatives and its commitment to maintaining its progressive dividend policy.

It said 2H21 will be a stronger cash generative period than 1H21 and, as a result, it expects to further rationalise borrowings before the end of FY21. Its long-term policy is to maintain a strong financial position and keep the ratio of net debt to adjusted EBITDA under two times.

Following these results, and with ‘a robust and balanced forward order book’, Michelmersh said it looks forward to continued positive trading for the remainder of the financial year.

(Source: Michelmersh Brick Holdings 2021 Interim Results Presentation)

(Source: Michelmersh Brick Holdings 2021 Interim Results Presentation)

The Group said its performance in 1H21 has continued into the first few months of 2H21 and, with the positive wider sentiment in its end markets, with both new UK housing and the RMI market, the Board expects to be modestly ahead of market expectations for the full year.

It added that it maintains its watchful approach due to the ongoing disruption caused by the Covid-19 pandemic with macro inflation risk prevalent in its supply chain as well as the direct impact on its labour and haulage availability as a result of government test and trace policy.

As a result, the Directors highlighted to investors that they are maintaining ‘a cautious view on these background factors and the effect they may have on profitability over the second half’ and, as a result, the Company expects profits to be distributed more to the first half of trading.

Nevertheless, the Company said the underlying momentum in its business remains very positive and it is well placed to continue to deliver growth for the second half and beyond.

Chairman, Martin Warner said, "We have entered 2H21 with a strong and balanced order book and we are continuing to see positive order intake momentum from our customers against the wider backdrop of recovery in the construction sector and demand in our key markets.”

He added: “Alongside this positive outlook we remain watchful of some of the broader risks impacting our sector and the UK economy and we continue to see the potential for disruption to our labour and haulage availability and wider inflation risks.

With our strong order book and with demand from our customers expected to continue, the Board expects to be modestly ahead of the current financial year expectations and remains confident in the strategic outlook of the business."

Follow News & Updates from Michelmersh Brick Holdings here: You can find a copy of the Company's 2021 Interim Results Presentation here.