Generating ‘Alpha’ is all about finding best-of-breed stocks trading at attractive prices.

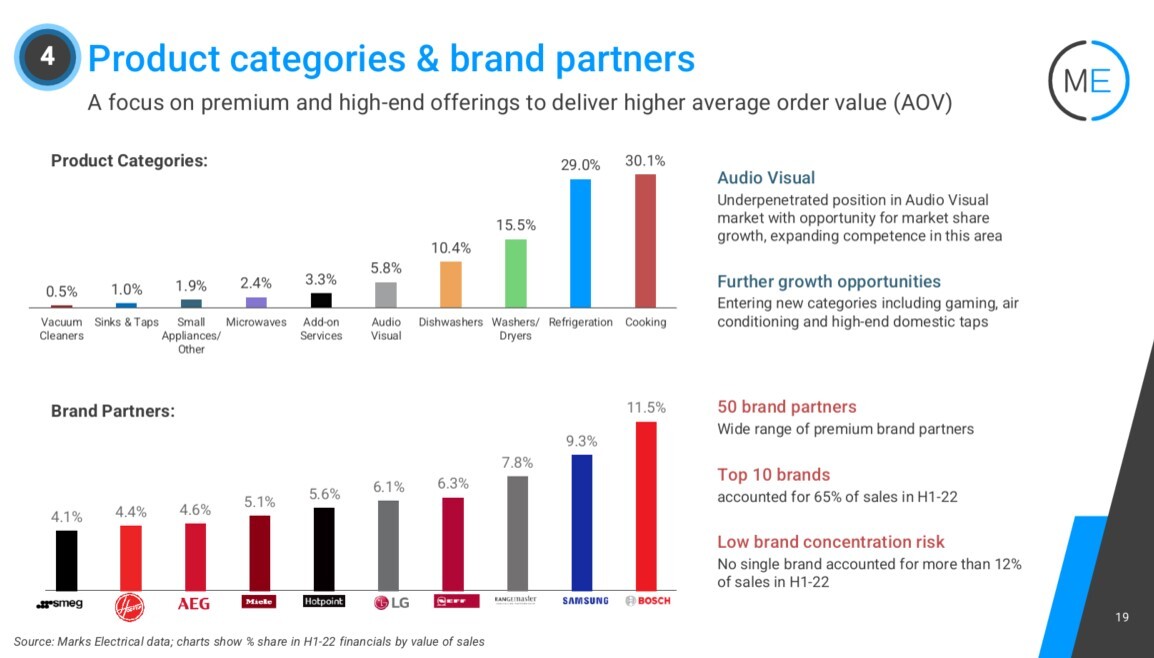

Here long term investors should run the slide rule over recently IPO’d (at 110p) Marks Electrical (MRK ) A fast growing, online retailer of premium household appliances such as cookers, televisions, fridges, freezers & dish-washers.

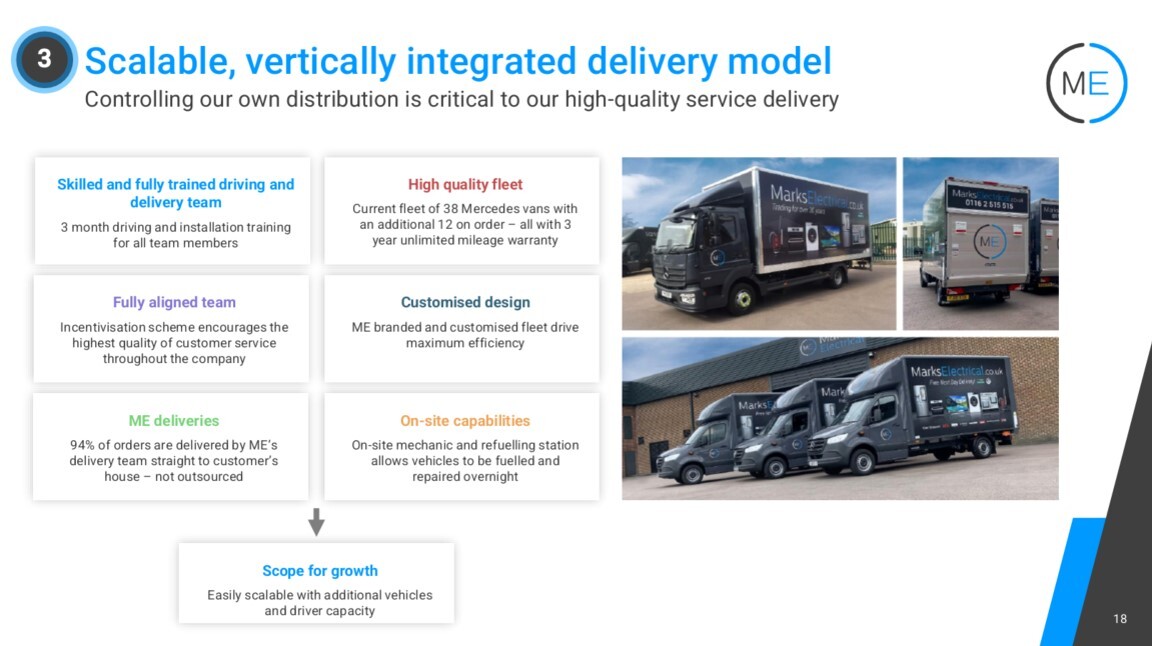

Today the company said that Q3 LFL revenues climbed 27.4% to a record £22.3m vs tough comparatives with improved market share (1.5% H1’22). Reflecting strong Black Friday & Xmas demand, alongside excellent customer service (4.8 Trustpilot score out of max 5.0), product availability and 1-day delivery.

In contrast, larger digital rival AO revealed in November that its seasonal sales would decline YoY, partly due to a “shortage of delivery drivers & supply chain disruption”.

Moreover despite increased promotional activity, this growth has also translated into favourable operating leverage (re overhead contribution) with FY’22 EBITDA margins tracking towards 9% (vs H1 at 8.1%).

Meaning overall, MRK is “on track” to achieve Panmure Gordon’s FY’22 revenues & adjusted EBIT targets of £81.2m (YTD £59.8m) & £6.6m (9.1%) respectively.

However this is just the start. CEO, founder & entrepreneur Mark Smithson wants to ultimately lift MRK’s share of the £5.3bn UK market to 10%. Which theoretically - assuming a 9% EBITDA margin and a 15x multiple - would generate a £675m valuation, or 640p/share vs 120p today.

Plus, even if one only factored in a modest 3.8% share (ie revs £200m), then this would still produce a 250p/share figure.

Mr Smithson adding ”We’ve continued to work closely with all our suppliers in order to maintain inventory levels during the period, and have successfully coped with the continued surge in demand for our products, achieving record delivery numbers and ensuring we maximise the value on each vehicle. In a market with supply issues, this demonstrates the strength of our relationships with our suppliers and the agility of our business model to cope with peak demand.

I am particularly proud of our further improvement on Trustpilot from 4.7 to 4.8, recognising the market-leading customer service that we provide. Our momentum has continued into January and we look forward to maintaining our performance management discipline on revenue, profit and cash in [Q4]”.