I3 Energy (I3E ) has described the year to 31 December 2021 as a year of “very significant” growth across all factors - production, cashflow, reserves and portfolio scale and scope.

The independent oil and gas company, which has assets and operations in both the UK and Canada, reported £86.8 million in group revenue for FY21 and net operating income of £48.8 million. By the period end, the Company’s cash flow from operations stood at £24.4 million.

During the course of 2021, i3 paid total dividends of 0.36 p/share, equating to a yield of around 6.5% for i3's shareholders based on i3's closing share price on 1 January 2021.

In December 2021, the Company announced that it was committing to pay a minimum of £11.827 million in dividends during the course of 2022 - that’s 3.5x all dividends paid during 2021 - equating to 1.05 pence per share or a 10.2% yield on the date of announcement.

This means a forecasted “2022 Unencumbered Cash” of US$66m which i3 said could support shareholder distributions or share buybacks, M&A, and supplemental development activity.

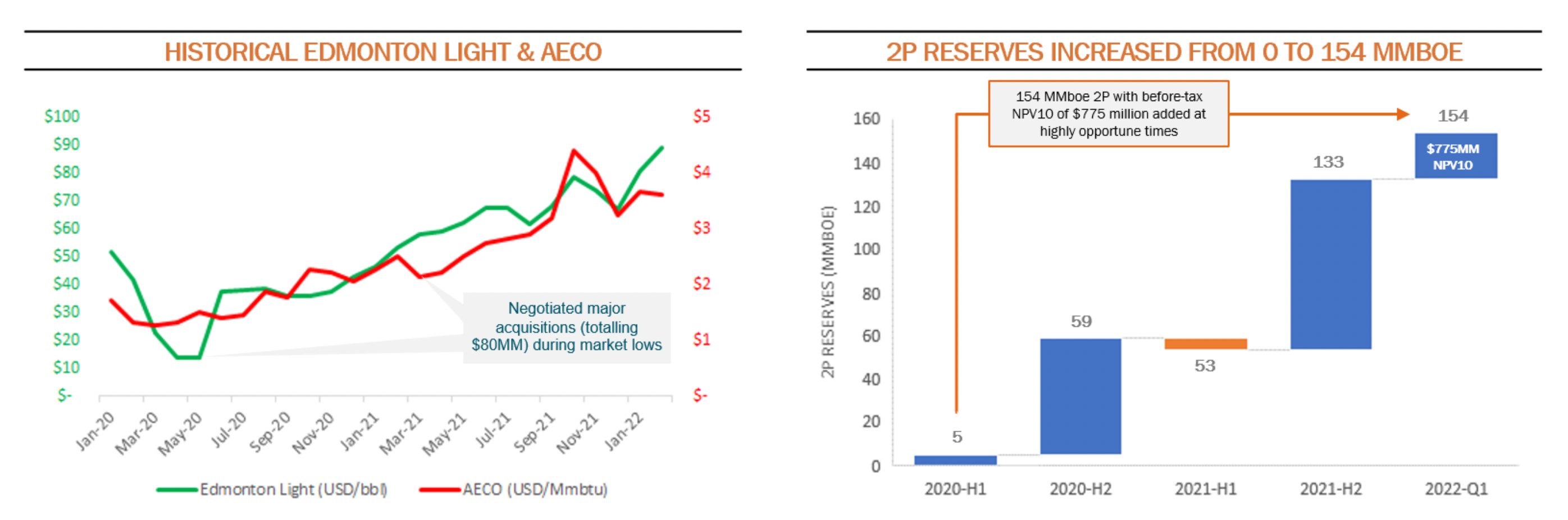

The Company entered the financial year having completed two acquisitions in late January 2020 which saw its entry to the Canadian E&P market with circa 9,000 boepd of production.

As a result, full-year production averaged 12,442 boepd, with 4Q21 including the newly integrated Central Alberta assets acquired from Cenovus Energy averaging 18,229 boepd (compared to 13,239 boepd in 3Q21, 9,018 boepd in 2Q21 and 9,173 boepd in 1Q21).

To fund the Cenovus acquisition, which was first announced in July 2021, i3 raised around £40 million through the placing and subscription of 363,700,000 shares at an issue price of 11 pence per share, a 3% discount to the company’s 15-day average closing price of 11.4 pence.

“Our organic reserve replacement ratio for the year was over 200%, and this was achieved on the back of hundreds of well interventions which are a testament to the dedication of all our staff from field operations to those based in the office,” said Majid Shafiq, CEO of i3 Energy.

“The acquisition of circa 8,400 boepd in our core Central Alberta area from Cenovus Energy, and other strategic acquisitions in our Simonette Montney acreage and the Clearwater play which has given us exposure to significant near-term share price catalysts,” he commented.

He further highlighted to investors: “Analysis and prioritisation of our substantial drilling portfolio over the course of the second half of the year allowed us to announce in December our inaugural operated drilling program which commenced in January 2022, and which will see us drilling circa 12.6 net wells during the first three quarters of the year. In the UK we continued discussions with potential farminees for our Serenity appraisal well and in March 2022 announced a deal which will allow us to spud the well later this year.”

I3 has exited 1Q22 producing in excess of 20,000 boepd with year-end audited 2P reserves of 154 MMboe with a valuation of US$775mm and forecast NOI for the year of US$192mm.

I3 said it remains focused on growing its Canadian business and drilling an appraisal well at its Serenity oil discovery in the UK to prove reserves and to guide future development plans.

i3 has already agreed to terms with a potential farm-in partner for the Serenity field appraisal drilling programme and, at year-end, it was awaiting confirmation of funding commitments from the potential farm-in partner before finalising and executing documentation, it noted.

i3 has a fully funded 2022 capital budget of US$47 million to fund a 12.6 net well operated drilling programme, non-operated drilling, well reactivations, debottlenecking, consolidation, and third-party tariff generating projects. This programme is expected to deliver average corporate production in 2022 above 20,000 boepd, with peaks reaching 21,000 boepd.

“We are confident we will add substantial shareholder return through exploitation of the extensive portfolio of drilling options we have lined up for 2022,” Shafiq told investors.

Follow News & Updates from I3 Energy: