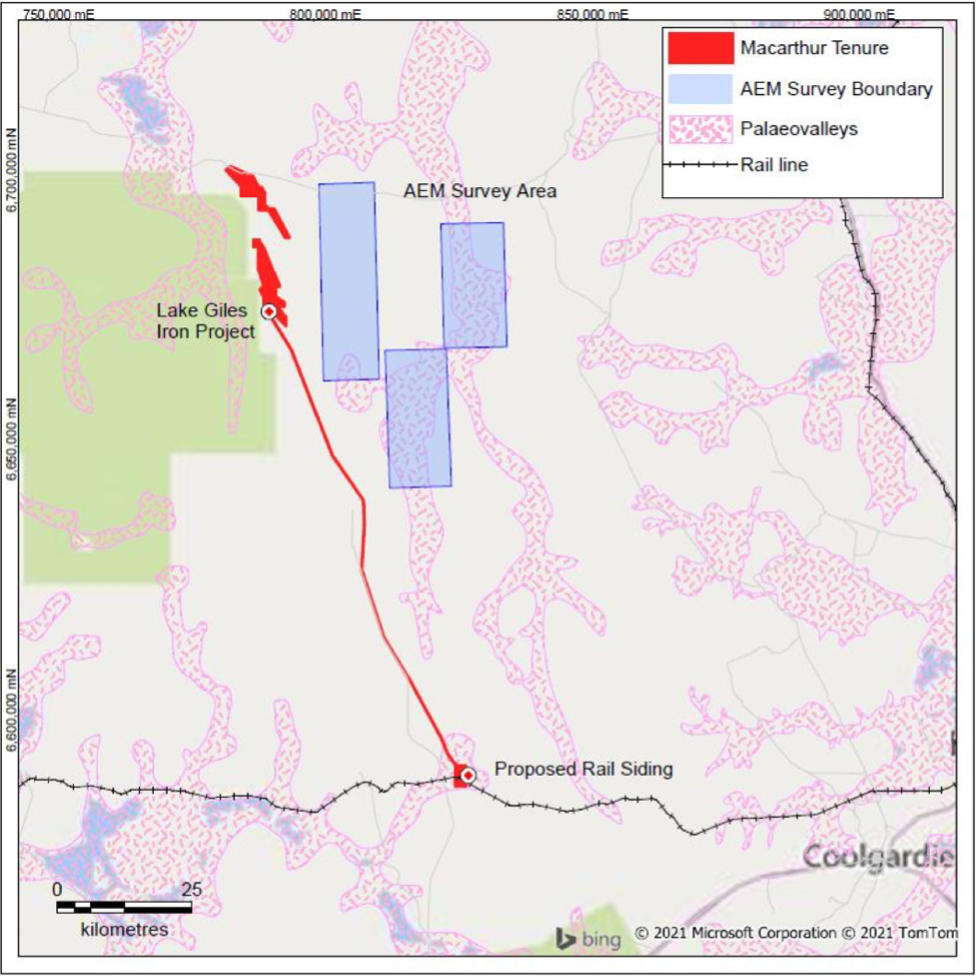

Cadence Minerals (KDNC ) has noted a statement from Macarthur Minerals in which it told investors that an airborne AEM survey (Fig.1) has now been completed by CGG Aviation to identify groundwater targets near the Lake Giles Iron Project in Western Australia.

Cadence holds around 1% of the issued equity interest in Macarthur, an Australian mining exploration firm focused primarily on iron ore, nickel, lithium and gold in Western Australia.

The group said CGG Aviation has undertaken an airborne AEM survey covering an area of 970 km2 over 1322-line kilometres with the objective of assessing the Rebecca palaeovalley.

The Rebecca system is expected to contain a large amount of groundwater and is not exploited by other operators. The western limb of the Rebecca palaeovalley is located approximately 15 to 40 km east of Lake Giles and extends over 160 km North to South.

Figure 1. Tempest AEM Survey area over the Rebecca Palaeovalley as mapped by the Kalgoorlie 1:1,000,000 Sheet. Project GDA94, Zone 50.

(Source: Macarthur Minerals)

The system is one of several buried palaeovalleys in the goldfields, with others exploited by BHP's Nickel West project, Glencore's Murrin Murrin project and Gold Road's Gruyere project.

Cadence outlined how CGG had mobilised to the site on 10 March 2021 and that the aerial survey was completed over a period of 5 days where electromagnetic data was collected.

The Tempest AEM system is suited to conductivity mapping and has previously been utilised for mapping the location, extent and basement topography of palaeodrainage systems.

The data will be interpreted by hydrologists from Rockwater, who are experts in the application of hydrological surveys, to define suitable targets for groundwater exploration.

Commenting on the AEM survey, Andrew Bruton, CEO of Macarthur Minerals said, “The airborne survey programme of the paleovalley adjacent to the Lake Giles Iron Project will identify suitable drill targets for groundwater exploration to enable the Company to test the quantity and quality of water required to support its magnetite processing requirements.

He added, “Macarthur is pleased to be working with CGG Aviation and Rockwater on this important component of work which will feed into the Company’s Feasibility Study.”

The Lake Giles mineral resources include the Ularring hematite resource comprising Indicated resources of 54.5 million tonnes at 47.2% of iron and Inferred resources of 26 million tonnes at 45.4% of iron; and the Lake Giles magnetite resource of 53.9 million tonnes (Measured), 218.7 million tonnes (Indicated) and 997 million tonnes (Inferred).

Shares in Cadence Minerals have increased by nearly 30% since the beginning of 2021. The stock ticked up 2.70% higher this morning to 19p immediately following the announcement.

The survey conducted will identify suitable drill targets for Macarthur Minerals to test the quantity and quality of water required to support its magnetite processing requirements.

In a recent quarterly update, Macarthur said it is ‘well placed’ to deliver on its stated 2021 goals for Lake Giles, which include completing a feasibility study, concluding a route-to-market contract and advancing terms of financing the project commencing 2023.

Analysts at Morgan Stanley have also held on to a bullish scenario for iron ore prices in the years ahead. In a recent report, analysts laid out a ‘plausible scenario’ of iron ore prices trading at more than $US165 per tonne ($216/tonne) for a three-year period out to 2024.

‘Global iron ore production growth will accelerate in the coming years, bringing an end to the stagnation that has persisted since iron ore prices hit a decade-low average of $55 per tonne in 2015,’ market analyst Fitch Solutions predicts within its latest industry report.

Reasons to KDNC

Amapá – 30% (once final agreement with bank creditors has been completed)

Candece plans to rehabilitate Amapá, including commissioning the studies required of bank finance, shipping of the iron ore from the stockpile and the restarting of full operations.

The historic mine plan would mean that Amapá would produce at steady-state production an estimated 4.4 Mt of 65% iron and 0.9 Mt of 62% iron per annum for approximately 14 years.

Cinovec – 16%

Cadence holds around 12% of the equity in European Metals, which, through its subsidiary, Geomet, controls the exploration licences awarded for the Czeach Cinovec Lithium Project.

Cinovec, which is the largest hard rock lithium deposit in Europe, is strategically located to produce lithium for Europe with the goal of contributing to a sustainable supply chain for a world leading centre for electric vehicle development and manufacture in Europe.

Diego Pavia, CEO of EIT InnoEnergy, said he views Cinovec as “critical” to the development of Europe's energy storage industry and in meeting the EU's climate goals of electrification of mobility and large-scale development of renewable energy storage.

Last week, the ongoing nineteen-hole resource drilling programme at the Cinovec Project returned strong drilling results. Cadence’s Chief Executive, Kiran Morzaria told investors that the encouraging results ‘serve to highlight the overall quality of the Cinovec project.’

Yangibana – 30%

Last year, Cadence unveiled ‘outstanding’ rare earth oxide grades in a report which highlighted positive drilling results at the Yangibana rare earth project in Australia, exceeding its expectations for its planned 20,000 metre 2020 exploration drill program.

Cadence, which owns 30% of three mining leases and six exploration licences which form part of the Yangibana Rare Earth Deposit, expects to advance the programme until Q420.

Follow News & Updates from Cadence Minerals here: