Investors looking for diversification in these troubling times for equities, bonds, property and FX, then they should look at uncorrelated returns through Alpha Growth plc (“Alpha”)

Alpha is a financial advisory business providing specialist consultancy, advisory and supplementary services to institutional and qualified investors globally in the multi-billion-dollar market of longevity assets class.

Whilst the longevity asset class is often overlooked, particularly outside the US, Alpha was established to be a specialist in this asset class serving institutional investors during time of high volatility across other asset classes.

We spoke to Alpha CEO about the current markets and how it is affecting their business.

How have life settlements correlated to the S&P 500, both in periods of prosperity and more important, during corrective/turbulent periods?

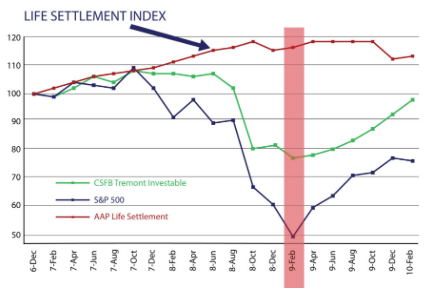

Alpha’s strategies which include the BlackOak Alpha Growth Fund is attractively positioned during these uncertain times. Life Settlements have less of a causal relationship as the value that is created is a function of the appropriate estimation of life expectancy of the insured lives. Life expectancy, of course, has NOTHING to do with financial markets. Hence, investment performance is directly linked to the life expectancy of the insured both in collecting mortality proceeds if policies are sold prior to the mortality event.

Therefore, the asset conceptually has a NO correlation to equity, property or bond markets, but can sometimes mildly correlate based on overall capital market liquidity, and in that case, we are in the fortunate position of being able to just wait and watch our portfolio build value as the insured portfolio matures.

The chart to the left shows the reaction of the Life Settlement Index, a tracking index established by AA Partners Ltd (discontinued 2014) comparing the index to a CSFB hedge fund index and the S&P 500. The AAP Life Settlement Index tracked the performance of funds implementing an investment strategy in U.S. life insurance policies (“life settlements”).

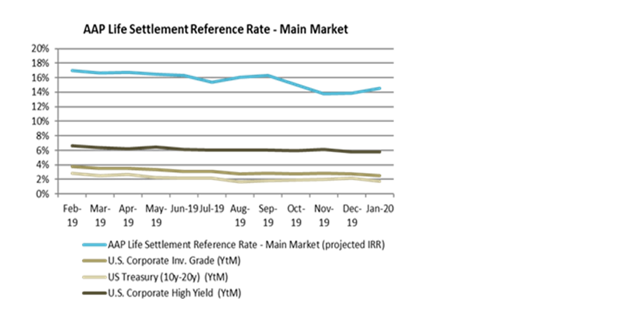

Austin B. King, Director of Investor Relations for the BlackOak Alpha Growth Fund, adds that the non-correlated aspects of the funds underlying assets have been a key draw of interest from investors, but given the trend for an even lower yield environment - 10yr T bill below 1% - the funds predictable cash flow and target rate of returns of 10% to 14% adds to the appeal.

Does the Covid19 pandemic have a direct effect on the asset’s performance?

No direct effect. We acquire life settlements from a very broad segment of the population which of course is aging. The performance or returns are based on sound actuarial analysis and not reliant on exogenous events. The greatest impact this situation has had is on the financial markets and as said above we are well suited to provide alternatives to the institutional investors.

When will investors hear from the Company next?

Alpha plans to update shareholders before the end of the month through a Vox Markets podcast.