88 Energy (88E ) said it has successfully closed its equity placing which raised £12.71m with a total of 855.8 million new shares being sold to investors at a price equivalent of 1.49p.

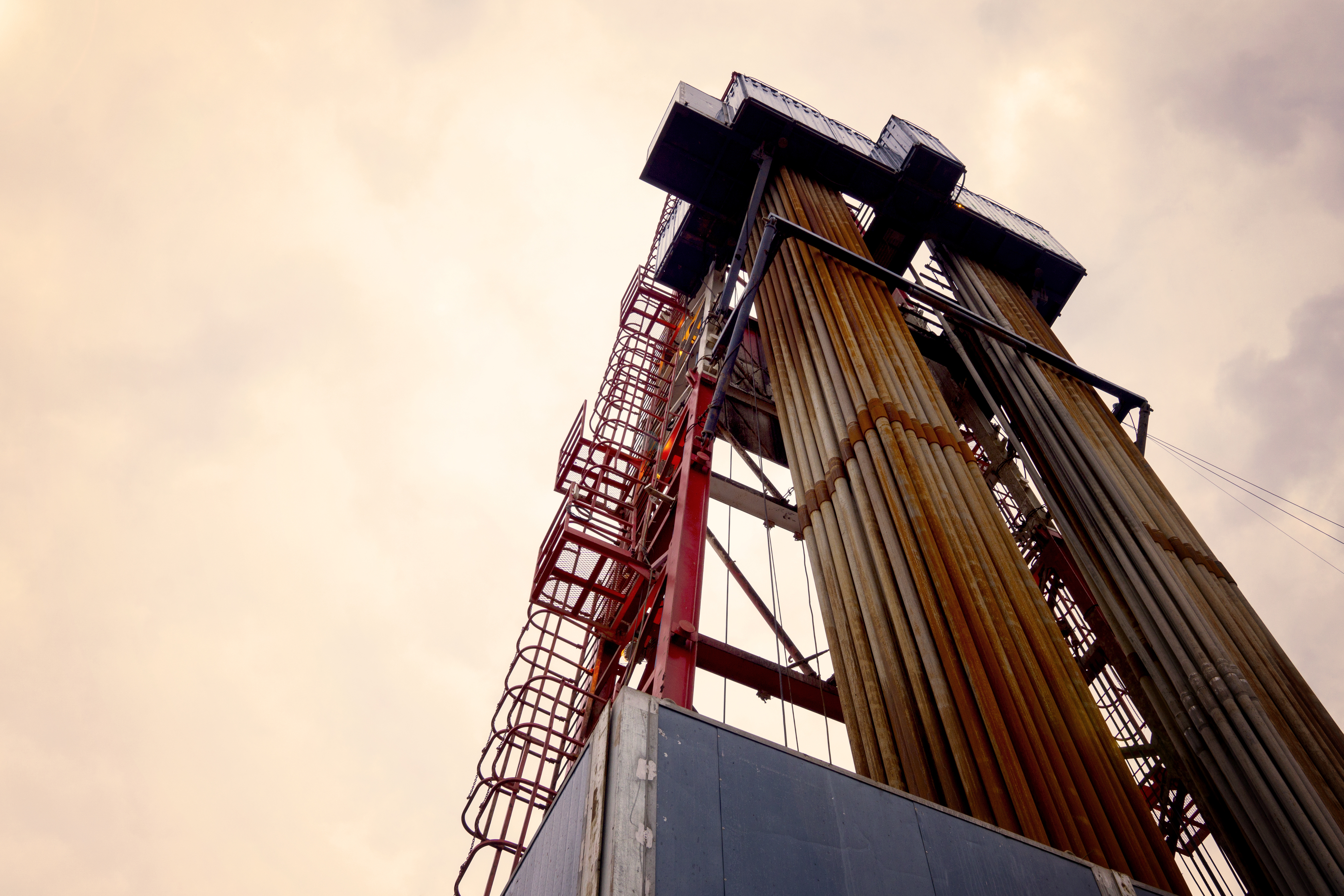

The dual-listed exploration company announced its intention to raise the proceeds on Tuesday in order to support the drilling and logging of its Merlin-2 appraisal well in 1Q22. Overall, the operation is targeting 652 million barrels in the N20, N19 and N18 horizons.

The Company explained that the proceeds will also be used to fund lease acreage payments as well as enable the identification and execution of potential new project opportunities.

Following completion of the placing, 88E will have sufficient cash to fund its ongoing working capital requirements and general and administrative overheads for the next year.

Following the success of the Merlin-1 program earlier this year where 88E confirmed light oil at the site, the Merlin-2 appraisal well will be designed to test the Nanushuk formation further to the east, where enhanced reservoir thickness and quality are expected.

In total, the Merlin-2 well will target a net entitlement mean Prospective Resource of 652 million barrels of oil (unrisked) and is scheduled to be drilled in Q1 CY2022, 88 explained.

88E’S MD and CEO, Ashley Gilbert, said: “Completion of this placing positions 88 Energy strongly as planning and preparations continue for drilling of the Merlin-2 appraisal well in 1Q.

Gilbert said 88E would continue to evaluate potential strategic partners for the Peregrine Project situated on the North Slope of Alaska and in which it holds a 100% working interest.

“However, ensuring our ability to fully fund Merlin-2 via this placing delivers us excellent commercial leverage and optionality with respect to these discussions,” 88E explained.

88E said other key activities over the next months include the targeted unlocking of value in its Yukon acreage via advancing negotiations with nearby resource owners for a joint development area, optimisation of Umiat oil field development plans, as well as the reassessment of its Icewine acreage following Talitha-1 which was drilled earlier this year.

In early August 2021, the Company released its results for the 1H21 period in which it stated that as at 30 June 2021 the Company had cash resources of A$14.8 million and zero debt.

During 1H21, 88E completed drilling at Merlin-1 and commenced a post-well evaluation which successfully demonstrated the presence of oil in multiple sequences. A new target was also penetrated to return a strong hydrocarbon signature following geochemical analysis.

Following the encouraging results from the neighbouring Talitha-1 well, 88E is undertaking a re-assessment of its Project Icewine acreage, ahead of a potential farm-out of its interests.

88E said it is planning for future exploration drilling on its Yukon acreage, which would be subject to farm-out and other considerations, such as ongoing discussions with nearby lease owners for a joint development area, ‘which has the potential to unlock value in this area.’

View from Vox

At the start of August 2021, shares in 88E jumped after the firm confirmed to investors that it had been granted a two-year extension for its obligations at the Umiat oil field in Alaska.

In an update, the Alaskan-focused exploration company said further studies in conjunction with post well testing at its Merlin-1 well has identified additional upside at the oil field.

The Company explained that a discovery at Project Peregrine, where future appraisal drilling is planned, would contribute ‘significant value’ to any development at the Umiat oil field.

88 Energy plans to utilise the next 24 months to investigate previous scoping studies and explore possible alternative development scenarios to improve the economics of Umiat.

In July 2021, shares in 88E jumped after it told investors that it had completed the sale of the Alaskan Oil and Gas Tax Credits, thereby allowing the group to fully repay its existing debt.

In June 2021, it entered into an agreement that would facilitate the sale of all these assets which were held by Accumulate Energy Alaska, Inc., a 100% owned subsidiary of 88 Energy.

The deal accelerates the timeframe of 88E’s value realisation from the Tax Credits, which under current estimates would not have been fully paid out by the Alaska state until 2026.

Following the confirmation of the transaction in July 2021, 88 Energy remains debt free (other than typical trade creditors) and held cash of A$14.8 million (unaudited) as at 30 June 2021.

The Merlin-1 well was spudded in March 2021 and targeted 645 million barrels of gross mean prospective resource. With drilling now complete, and the interpretation of the results underway, a second well, Harrier-1, targeting 417m barrels is planned to be drilled in 2022.

Drilling at the Merlin-1 well follows the Crude Oil WTI Index reaching its highest level since October 2018 in June 2021, with the commodity reaching highs of $67.98 per barrel.

Reasons to Follow 88E

The Alaskan explorer completed its acquisition of XCD Energy, which holds a 100% Working Interest in the highly prospective Alaskan North Slope, back in August 2020. The merged entity has formed a diversified portfolio of exploration projects on Alaska’s North Slope.

The combined company will have increased scale, market presence along with higher funding capability and trading liquidity across the ASX and London AIM exchanges.

The three key projects include Project Icewine, Yukon leases and Project Peregrine with the assets at various stages of development, the company previously outlined this summer.

In late 2020, 88E was also formally re-assigned the "Area A" leases at Project Icewine meaning its working interest in around 40% of the project has increased from 30% to 75%.

For more news and updates on 88 Energy here: