88 Energy (88E ) said it is investigating ‘encouraging evidence’ of downhole samples from its operations on the North Slope of Alaska which it said has indicated a potential oil discovery.

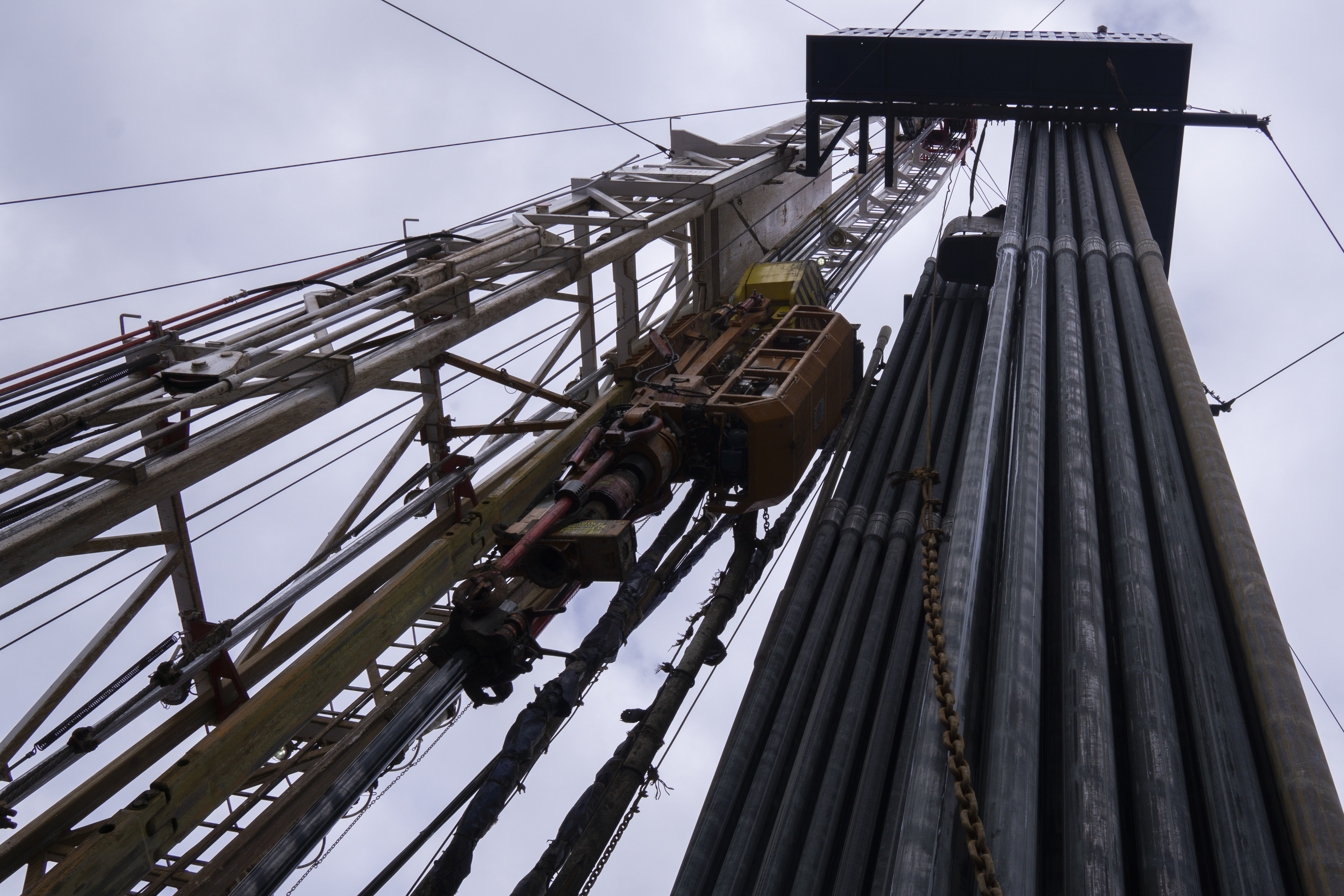

The samples come from the explorer’s Merlin-1 well at its 50% owned Project Peregrine in the NPR-A region of the North Slope of Alaska where previous observations from an optical fluid analysis sensor had indicated ‘the likely presence of oil in the formation fluid.’

While the percentages of hydrocarbons in the samples reach up to ~70%, which indicates a discovery, the results are qualitative, and the margin of error is uncertain meaning that further investigation is required to validate the actual percentage of hydrocarbons.

The ratios of hydrocarbons indicate that the liquid present is highly likely to be oil rather than condensate, which the company told investors ‘also bodes well from a thermal maturity perspective regionally’. The company added however that these horizons had previously been deemed to contain mostly water and that this still remains a possibility.

‘Regardless of the final percentages of hydrocarbon vs water in these samples the presence of oil is highly encouraging particularly given that the two most prospective horizons were not able to be sampled due to operational issues,’ the company informed investors, adding that the final percentages of hydrocarbon vs water will be known ‘in the coming weeks.’

While 88E prepares the sidewall cores for further testing, white and UV light photography will be undertaken and if oil is present, then fluorescence will be evident under UV light. To date, several horizons are said to have shown evidence of oil set to be the focus of further work.

The cost of the Merlin-1 well has now been largely finalised, with all major invoices now in hand and 88 Energy's net share of well costs is estimated to be US$9m, inclusive of wireline costs and additional costs associated with operational issues during the wireline program.

88E plans to settle the sum by issuing 345,000,000 new shares at $0.025 to the vendors, with the balance due to be settled in cash. The company highlighted that this will ensure that it is left in a strong financial position ahead of next winter's exploration program.

View from Vox

Shares in 88E have seen a near three-fold increase in value since the start of 2021 and the recent news that it had started drilling at Merlin-1 marked “an exciting and pivotal time”. The stock was trading 6.85% lower this morning at 1.26p following the announcement.

Drilling at the Merlin-1 well follows the Crude Oil WTI Index reaching its highest level since October 2018 last month, with the commodity reaching highs of $67.98 per barrel.

Reasons to 88E

Project Portfolio Across Alaska’s North Slope

The Alaskan explorer completed its acquisition of XCD Energy, which holds a 100% Working Interest in the highly prospective Alaskan North Slope, back in August 2020. The merged entity has formed a diversified portfolio of exploration projects on Alaska’s North Slope.

The combined company will have increased scale, market presence along with higher funding capability and trading liquidity across the ASX and London AIM exchanges.

The three key projects include Project Icewine, Yukon leases and Project Peregrine with the assets at various stages of development, the company previously outlined this summer.

In late 2020, 88E was also formally re-assigned the "Area A" leases at Project Icewine meaning its working interest in around 40% of the project has increased from 30% to 75%.

For more news and updates on 88 Energy here: