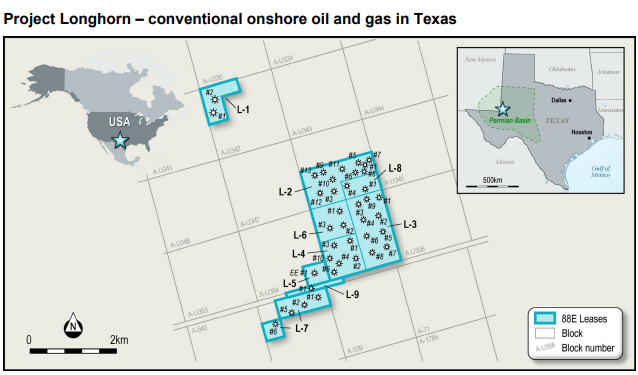

88 Energy (88E ) said its recently acquired Project Longhorn conventional oil and gas production assets in the proven Permian Basin have been performing well to date.

The project, in which the Alaskan-focused explorer has an around 73% average net working interest in, remains on track to complete the targeted seven capital development activities this year, which is expected to approximately double current production rates by the end of FY22.

88 Energy, which acquired the Longhorn Project which is located onshore Texas in the United States in 1Q22, said the acquisition represented its first move into producing oil and gas assets and is in line with its strategy to build a successful exploration and production firm.

As a result, the Company has a circa 73% average net working interest in these “established” production assets, which have independently certified net 2P reserves of 2.05 MMBOE.

The acquisition of its working interest has delivered 88 Energy immediate cash flow, as well as further low-cost capital development upside providing “appealing” forecast economics.

(Source: 88 Energy)

88 Energy said it is benefiting from recent increases to oil prices which have strengthened cash returns from the high-margin oil production within the firm’s Project Longhorn portfolio.

In March 2022, the Operator of the Longhorn production assets, Lonestar I, LLC, successfully completed the first of a series of capital-efficient work-overs planned after the completion of the Longhorn acquisition. This work-over was completed on time and on budget and has delivered an immediate increase to the total oil and gas production rates of the project.

At the end of March 2022, production from the Longhorn wells exceeded 400 BOE per day gross (over around 300 BOE per day net and around 70% oil), therefore representing an increase of over 30% since 88E’s completion of the acquisition in mid-February 2022.

The Company said the increase provides further direct exposure to the higher WTI oil price environment and accelerates pay-back on the acquisition of the assets and the capital investment in the seven work-overs which the company agreed to as part of its acquisition.

As part of the acquisition, 88 Energy agreed to a low-cost work program for FY22. The initiatives are expected to approximately double production rates by the end of the year.

88 Energy said the Project has exceptionally low operating costs (lifting costs), which provides high margins from production. First cash receipts from Longhorn were received by 88 Energy in March 2022, which comprised a payment of around A$0.6 million (net to the Company).

88 Energy highlighted to investors that it is in “a solid financial position,” with zero debt and a healthy cash balance that is expected to be further strengthened with projected cash flows from Project Longhorn’s Texas production assets. It said the program is expected to result in strong cash flow outcomes and further direct exposure to the current high energy prices.

88 Energy’s Managing Director and CEO, Ashley Gilbert, also told investors: “We are also highly encouraged by the successful delivery by the Operator of the first planned work-over, as well as the continued progress of the agreed capital development program for 2022.”

Follow News & Updates from 88 Energy: